All Categories

Featured

Table of Contents

The $40,000 increase over the initial proposal is the tax sale excess. Declaring tax sale excess suggests getting the excess cash paid during an auction.

That said, tax sale overage insurance claims have shared attributes throughout a lot of states. During this period, previous proprietors and home loan holders can get in touch with the region and get the excess.

If the duration ends before any kind of interested parties assert the tax obligation sale excess, the area or state usually takes in the funds. Past proprietors are on a stringent timeline to claim excess on their buildings.

, you'll gain interest on your entire proposal. While this facet doesn't indicate you can claim the excess, it does help mitigate your costs when you bid high.

Comprehensive Mortgage Foreclosure Overages Learning Overages Surplus Funds

Keep in mind, it might not be lawful in your state, implying you're limited to gathering rate of interest on the overage. As stated above, an investor can discover methods to benefit from tax obligation sale overages. How to Recover Tax Sale Overages. Because passion income can relate to your entire bid and previous owners can claim excess, you can take advantage of your understanding and devices in these situations to make best use of returns

As with any kind of financial investment, research is the vital opening action. Your due persistance will certainly give the required insight into the buildings available at the next auction. Whether you make use of Tax obligation Sale Resources for investment data or contact your county for details, an extensive assessment of each residential property allows you see which residential or commercial properties fit your financial investment design. A vital aspect to remember with tax sale excess is that in the majority of states, you only need to pay the area 20% of your total bid in advance. Some states, such as Maryland, have regulations that go past this policy, so once more, study your state regulations. That said, the majority of states comply with the 20% policy.

Instead, you only need 20% of the bid. Nevertheless, if the residential or commercial property does not redeem at the end of the redemption period, you'll need the continuing to be 80% to obtain the tax action. Due to the fact that you pay 20% of your proposal, you can make passion on an excess without paying the complete price.

Groundbreaking Mortgage Foreclosure Overages Blueprint Tax Sale Overage List

Once again, if it's lawful in your state and county, you can work with them to help them recuperate overage funds for an added charge. You can gather passion on an overage quote and bill a cost to improve the overage claim procedure for the past owner.

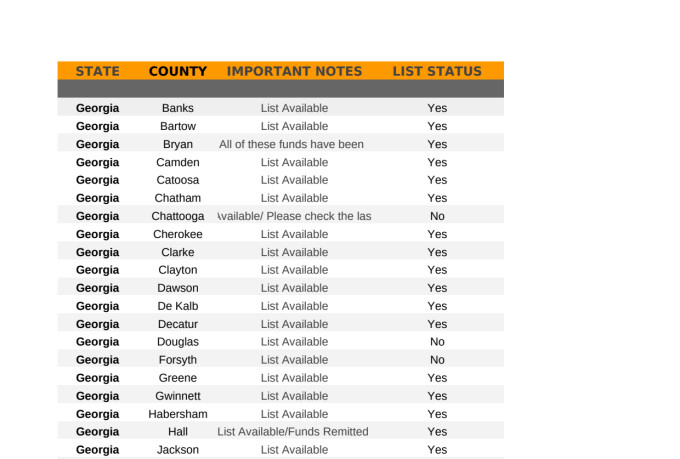

Overage collection agencies can filter by state, region, residential property type, minimal overage quantity, and maximum excess amount. When the data has been filtered the collectors can decide if they wish to add the miss mapped information package to their leads, and afterwards spend for only the validated leads that were located.

In addition, just like any type of various other financial investment technique, it offers one-of-a-kind pros and disadvantages.

Groundbreaking Bob Diamond Tax Sale Overages Blueprint Mortgage Foreclosure Overages

Otherwise, you'll be prone to hidden dangers and legal ramifications. Tax sale overages can develop the basis of your investment design due to the fact that they offer a low-cost method to make money. As an example, you don't need to bid on buildings at public auction to buy tax obligation sale excess. Rather, you can investigate existing excess and the previous owners that have a right to the cash.

Rather, your study, which may include avoid mapping, would certainly cost a relatively small cost.

Exceptional County Tax Sale Overage List Training Unclaimed Tax Sale Overages

Your sources and method will identify the finest environment for tax obligation overage investing. That claimed, one strategy to take is accumulating rate of interest on high costs.

Any auction or repossession entailing excess funds is a financial investment chance. You can invest hours researching the previous proprietor of a residential or commercial property with excess funds and contact them only to find that they aren't interested in seeking the cash.

You can start a tax overage company with minimal costs by locating information on recent buildings offered for a costs bid. You can contact the past proprietor of the home and use a cost for your solutions to aid them recover the excess. In this scenario, the only expense entailed is the research rather than spending 10s or numerous countless dollars on tax obligation liens and actions.

These excess usually create interest and are offered for past proprietors to claim - Unclaimed Tax Sale Overages. For that reason, whether you purchase tax liens or are exclusively thinking about claims, tax obligation sale excess are investment opportunities that need hustle and solid research study to turn an earnings.

In-Demand Tax Lien Overages Program County Tax Sale Overage List

An event of rate of interest in the residential or commercial property that was cost tax sale may assign (transfer or sell) his or her right to declare excess proceeds to another person just with a dated, composed paper that clearly mentions that the right to claim excess proceeds is being appointed, and only after each event to the proposed task has disclosed to each various other celebration all facts associating to the value of the right that is being designated.

Tax obligation sale excess, the excess funds that result when a residential or commercial property is cost a tax obligation sale for greater than the owed back tax obligations, charges, and costs of sale, stand for an alluring opportunity for the original residential or commercial property owners or their successors to recoup some worth from their lost possession. The process of claiming these overages can be complicated, bogged down in legal treatments, and vary considerably from one territory to one more.

When a residential property is sold at a tax sale, the main objective is to recover the unpaid residential property tax obligations. Anything over the owed amount, consisting of penalties and the expense of the sale, comes to be an excess - Tax Overages List. This overage is essentially money that must truly be gone back to the previous property owner, presuming no various other liens or cases on the home take precedence

Latest Posts

Buy Houses For Taxes

Tax Lien Investing Crash Course

Properties Sold For Unpaid Taxes